Why Private Real Estate

Private real estate has improved portfolio performance

- Private real estate has historically offered a unique blend of attractive characteristics for portfolio diversification, including strong absolute returns, low volatility, and low correlation with other asset classes

- Empirical evidence supports the positive impact of including private real estate in a portfolio, as it has been consistently shown to enhance total returns while potentially mitigating risk

Analysis of synthetic portfolio returns

|

60-40 Stocks & Bonds |

50-30-20 Stocks, Bonds & Private Equity Real Estate |

|

|---|---|---|

|

1-Yr. |

(15.3%) |

(9.8%) |

|

3-Yr. |

5.9% |

6.9% |

|

5-Yr. |

7.1% |

7.6% |

|

10-Yr. |

8.7% |

9.1% |

|

15-Yr. |

6.8% |

7.0% |

|

20-Yr. |

8.0% |

8.3% |

|

20-Yr. Std. Dev.(1) |

10.0% |

8.8% |

|

Return/Risk Ratio(2) |

0.80 |

0.95 |

Source: National Council of Real Estate Investment Fiduciaries (“NCREIF”), Barclays, S&P Dow Jones, BGO Research. NCREIF data reflects the returns of a blended, large portfolio of institutional quality real estate and does not reflect the use of leverage or the impact of management and advisory fees. Equities are represented by the S&P 500 total return index and are subject to market risk. Treasury Bonds are represented by the Barclays U.S. Aggregate Bond Index and is subject to interest rate risk. Government bonds are guaranteed as to the timely payment of principal and interest. Indices are meant to illustrate general market performance; it is not possible to invest directly in an index. The NCREIF data, and other indices presented, have material differences from an investment in IREIT by BGO, including those related to investment objectives, risks, fees and expenses, liquidity and tax treatment. Although IREIT by BGO’s share price is subject to less volatility, IREIT by BGO shares are significantly less liquid than these asset classes, and are not immune to fluctuations. Private real estate is not traded on an exchange and will have less liquidity and price transparency. The value of private real estate may fluctuate and may be worth less than was initially paid for it.

Note: Data through September 30, 2022; assumes no rebalancing from initial investment. Past performance is not indicative of future results. There is no guarantee that any trends shown herein will continue.

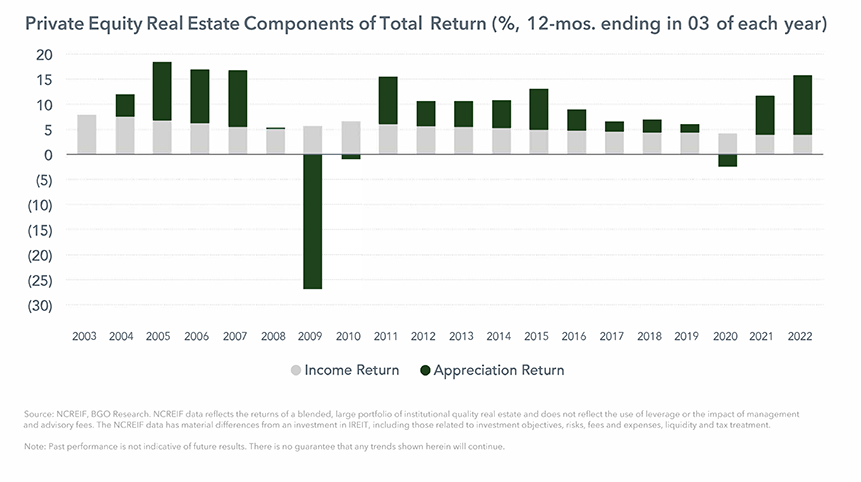

Historically, current income has driven real estate returns

- A significant portion of real estate returns is derived from income, which has consistently accounted for over 60% of private real estate's total return over the past 20 years(3)

- Investment yields in real estate have historically averaged approximately 280 basis points higher than the 10-Year Treasury over the last two decades(4)

Real estate has been a strong inflation hedge

Historically, private real estate has a higher correlation to the Consumer Price Index (CPI) than stocks and bonds, making it a potentially valuable hedge against inflation

- During periods of elevated inflation, buildings become more expensive to replace and rental rates tend to see stronger growth

- Lease contracts in private real estate are expected to provide a stable source of cash flow, often including periodic escalations that align with inflation

- In the case of industrial properties, many lease structures allow for operating expense increases driven by inflation to be passed on to tenants, further potentially mitigating the impact of inflation on cash flow

40-Yrs. of Performance vs. Inflation

|

Median Inflation Rate |

Median Total Return |

|

|---|---|---|

|

Lowest 10 Inflation Yrs. |

1.4% |

7.7% |

|

Low-to-Moderate 10 Inflation Yrs. |

2.3% |

9.8% |

|

Moderate-to-High 10 Inflation Yrs. |

3.0% |

9.7% |

|

Highest 10 Inflation Yrs. |

4.6% |

10.7% |

Source: NCREIF, Barclays, S&P Dow Jones, Bureau of Labor Statistics, BGO Research. NCREIF data reflects the returns of a blended, large portfolio of institutional quality real estate and does not reflect the use of leverage or the impact of management and advisory fees. The NCREIF data has material differences from an investment in IREIT by BGO, including those related to investment objectives, risks, fees and expenses, liquidity and tax treatment. Although IREIT by BGO’s share price is subject to less volatility, IREIT by BGO shares are significantly less liquid than these asset classes, andare not immune to fluctuations. Private real estate is not traded on an exchange and will have less liquidity and price transparency.The value of private real estate may fluctuate and may be worth less than was initially paid for it.

Note: Chart data show 12-mos. ending in September of each year. Past performance is not indicative of future results. There is no guarantee that any trends shown herein will continue.

Disclaimers/References/Legal

IREIT by BGO cannot guarantee that it will make distributions, and if it does, IREIT by BGO may fund such distributions from sources other than cash flow from operations, including, without limitation, the sale of or repayments under its assets, borrowings, return of capital or offering proceeds and advances or the deferral of fees and expense reimbursements, and IREIT by BGO has no limits on the amounts it may pay from such sources.

(1) Standard deviation is a statistical measure of how dispersed the data is in relation to the average. Low standard deviation means data is clustered around the mean, and high standard deviation indicates data is more spread out.

(2) Risk-reward ratio is a mathematical calculation to measure the expected gains of a given investment against the risk of loss.

(3) Private real estate is represented by the NCREIF Property Index (NPI). NPI is a quarterly time series composite total rate of return measure of investment performance of a very large pool of individual commercial real estate properties acquired in the private market for investment purposes only. All properties in the NPI properties are held in a fiduciary environment. The NCREIF data has material differences from an investment in IREIT by BGO, including those related to investment objectives, risks, fees and expenses, liquidity and tax treatment.

(4) Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity.

-

This sales and advertising literature is neither an offer to sell nor a solicitation of an offer to buy securities. An offering is made only by the prospectus. This literature must be read in conjunction with the prospectus in order to fully understand all of the implications and risks of the offering of securities to which the prospectus relates. A copy of the prospectus must be made available to you in connection with any offering. No offering is made except by a prospectus filed with the Department of Law of the State of New York. Neither the Securities and Exchange Commission, the Attorney General of the State of New York nor any other state securities regulator has approved or disapproved of our common stock, determined if the prospectus is truthful or complete or passed on or endorsed the merits of the offering. Any representation to the contrary is a criminal offense.

Past performance does not guarantee future results. Financial data is estimated and unaudited. The words “we,” “us,” and “our” refer to IREIT by BGO, together with its consolidated subsidiaries, including BGO REIT Operating Partnership LP, unless the context requires otherwise.

Opinions expressed reflect the current opinions of IREIT by BGO as of the date appearing in the materials only and are based on IREIT by BGO’s opinions of the current market environment, which is subject to change. Stockholders, financial professionals and prospective investors should not rely solely upon the information presented when making an investment decision and should review the most recent prospectus, as supplemented, available at www.bgoireit.com. Certain information contained in the materials discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice.

-

An investment in shares of common stock of BGO Industrial Real Estate Income Trust, Inc. (“IREIT”) involves a high degree of risk. These securities should only be purchased if you can afford to lose your complete investment. Please read the prospectus for a description of the material risks associated with an investment in IREIT by BGO. These risks include, but are not limited to, the following:

- We have no operating history and there is no assurance that we will be able to successfully achieve our investment objectives.

- This is a “blind pool” offering. Other than the Seed Joint Venture (as defined in the prospectus), you will not have the opportunity to evaluate our future investments before we make them.

- Since there is no public trading market for shares of our common stock, repurchase of shares by us will likely be the only way to dispose of your shares.

- Our share repurchase plan will provide stockholders with the opportunity to request that we repurchase their shares on a monthly basis, but we are not obligated to repurchase any shares and may choose to repurchase only some, or even none, of the shares that have been requested to be repurchased in any month. In addition, repurchases will be subject to available liquidity and other significant restrictions. Further, our board of directors may make exceptions to, modify or suspend for any period of time or indefinitely our share repurchase plan if in its reasonable judgment it deems such action to be in our best interest and the best interest of our stockholders, such as when repurchase requests would place an undue burden on our liquidity, adversely affect our operations or risk having an adverse impact on us that would outweigh the benefit of repurchasing our shares. Upon suspension of our share repurchase plan, our share repurchase plan requires our board of directors to consider at least quarterly whether the continued suspension of the plan is in the best interest of the Company and its stockholders; however, we are not required to authorize the recommencement of the share repurchase plan within any specified period of time. Our board of directors cannot terminate our share repurchase plan absent a liquidity event which results in our stockholders receiving cash or securities listed on a national securities exchange or where otherwise required by law. As a result, our shares should be considered as having only limited liquidity and at times may be illiquid.

- We are a perpetual-life REIT. While we may consider a liquidity event at any time in the future, we are not obligated by our charter or otherwise to effect a liquidity event at any time.

- We cannot guarantee that we will make distributions, and if we do we may fund such distributions from sources other than cash flow from operations, including, without limitation, the sale of or repayments under our assets, borrowings, return of capital and offering proceeds, and we have no limits on the amounts we may pay from such sources.

- The purchase price and repurchase price for shares of our common stock will generally be based on our prior month’s NAV (subject to material changes as described above) and are not based on any public trading market. While there will be independent annual appraisals of our properties, the appraisal of properties is inherently subjective, and our NAV may not accurately reflect the actual price at which our properties could be liquidated on any given day.

- We have no employees and are dependent on the Adviser to conduct our operations. The Adviser will face conflicts of interest as a result of, among other things, the allocation of investment opportunities among us and Other BGO Accounts (as defined in the prospectus), the allocation of time of its investment professionals and the substantial fees that we will pay to the Adviser.

This is a “best efforts” offering. If we are not able to raise a substantial amount of capital in the near term, our ability to achieve our investment objectives could be adversely affected. - On acquiring shares, you will experience immediate dilution in the net tangible book value of your investment.

There are limits on the ownership and transferability of our shares. See “Description of Capital Stock—Restrictions on Ownership and Transfer” in the prospectus. - If we fail to qualify to be taxed as a REIT for U.S. federal income tax purposes and no relief provisions apply, our NAV and cash available for distribution to our stockholders could materially decrease.

- We do not own the BGO name, but we are permitted to use it as part of our corporate name pursuant to a trademark license agreement with an affiliate of BentallGreenOak. Use of the name by other parties or the termination of our trademark license agreement may harm our business.

-

This sales and advertising literature contains forward-looking statements about IREIT by BGO’s business, including, in particular, statements about its plans, strategies and objectives. You can generally identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue” or other similar words or the negatives thereof. These statements include IREIT by BGO’s plans and objectives for future operations, including plans and objectives relating to future growth and availability of funds, and are based on current expectations that involve numerous risks and uncertainties. Assumptions relating to these statements involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to accurately predict and many of which are beyond IREIT by BGO’s control. Although IREIT by BGO believes the assumptions underlying the forward-looking statements, and the forward-looking statements themselves, are reasonable, any of the assumptions could be inaccurate and, therefore, there can be no assurance that these forward-looking statements will prove to be accurate and IREIT by BGO’s actual results, performance and achievements may be materially different from that expressed or implied by these forward-looking statements. In light of the significant uncertainties inherent in these forward-looking statements, the inclusion of this information should not be regarded as a representation by IREIT by BGO or any other person that its objectives and plans, which IREIT by BGO considers to be reasonable, will be achieved.

You should carefully review the “Risk Factors” section of the prospectus for a discussion of the risks and uncertainties that IREIT by BGO believes are material to its business, operating results, prospects and financial condition. Except as otherwise required by federal securities laws, IREIT by BGO does not undertake to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

BentallGreenOak Real Estate US LLC, Dealer Manager / Member FINRA

Check the background of this firm on FINRA's Broker Check

Learn more about FINRA at www.finra.org